All Categories

Featured

Table of Contents

The are entire life insurance policy and universal life insurance policy. grows money worth at an ensured rate of interest price and additionally with non-guaranteed dividends. expands cash money worth at a dealt with or variable rate, relying on the insurance company and policy terms. The cash worth is not contributed to the survivor benefit. Cash money value is an attribute you capitalize on while alive.

The policy car loan interest rate is 6%. Going this path, the passion he pays goes back right into his plan's money value rather of a monetary organization.

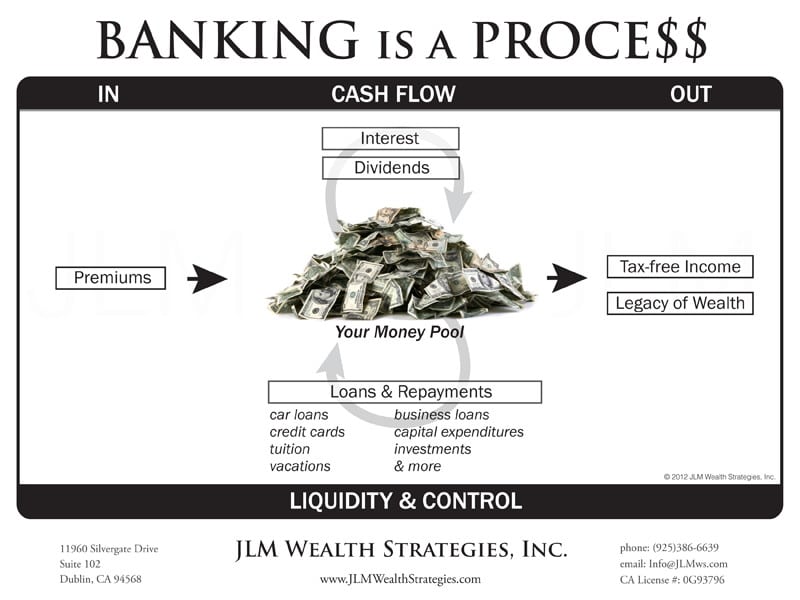

Visualize never ever needing to stress over small business loan or high rates of interest once more. Suppose you could borrow money on your terms and build wealth at the same time? That's the power of limitless banking life insurance policy. By leveraging the cash money value of entire life insurance IUL policies, you can grow your riches and borrow cash without relying upon typical banks.

There's no collection loan term, and you have the freedom to pick the repayment schedule, which can be as leisurely as repaying the financing at the time of fatality. This versatility reaches the servicing of the financings, where you can go with interest-only settlements, maintaining the car loan equilibrium level and workable.

Holding cash in an IUL repaired account being credited interest can usually be far better than holding the cash money on deposit at a bank.: You have actually always desired for opening your very own bakery. You can borrow from your IUL plan to cover the first expenditures of leasing an area, acquiring tools, and working with team.

Infinite Banking Concept Explained

Individual car loans can be gotten from traditional financial institutions and credit score unions. Borrowing cash on a credit history card is normally extremely pricey with yearly percentage prices of passion (APR) often getting to 20% to 30% or even more a year.

The tax obligation therapy of plan loans can differ substantially depending on your country of residence and the details regards to your IUL policy. In some regions, such as North America, the United Arab Emirates, and Saudi Arabia, plan car loans are typically tax-free, using a considerable advantage. Nonetheless, in other territories, there may be tax obligation effects to think about, such as potential tax obligations on the loan.

Term life insurance coverage only supplies a fatality advantage, without any kind of cash worth buildup. This means there's no cash worth to borrow against. This article is authored by Carlton Crabbe, Principal Exec Police Officer of Capital forever, an expert in supplying indexed universal life insurance policy accounts. The info provided in this post is for instructional and educational functions only and need to not be interpreted as monetary or investment recommendations.

Infinite Banking Nash

When you first listen to regarding the Infinite Banking Principle (IBC), your first response might be: This sounds too excellent to be true. The problem with the Infinite Financial Idea is not the idea however those individuals using a negative review of Infinite Financial as a concept.

As IBC Authorized Practitioners with the Nelson Nash Institute, we thought we would address some of the top questions individuals search for online when learning and comprehending whatever to do with the Infinite Banking Principle. What is Infinite Banking? Infinite Banking was developed by Nelson Nash in 2000 and totally described with the publication of his book Becoming Your Own Banker: Open the Infinite Financial Principle.

Infinite Banking Review

You think you are appearing financially in advance because you pay no rate of interest, yet you are not. When you conserve money for something, it typically suggests compromising something else and reducing back on your way of life in various other locations. You can repeat this procedure, but you are just "shrinking your way to riches." Are you happy living with such a reductionist or deficiency frame of mind? With saving and paying money, you may not pay interest, yet you are using your cash when; when you invest it, it's gone for life, and you quit on the opportunity to earn life time substance interest on that particular money.

Billionaires such as Walt Disney, the Rockefeller family and Jim Pattison have leveraged the buildings of whole life insurance policy that goes back 174 years. Also banks utilize whole life insurance policy for the very same objectives. It is called Bank-Owned-Life-Insurance (BOLI). The Canada Revenue Firm (CRA) even recognizes the value of getting involved whole life insurance policy as a special possession course used to generate long-lasting equity safely and naturally and supply tax obligation advantages outside the scope of conventional financial investments.

Ibc Life Insurance

It allows you to generate wide range by fulfilling the financial feature in your own life and the ability to self-finance major way of living acquisitions and expenditures without interrupting the compound passion. One of the simplest methods to think of an IBC-type taking part entire life insurance plan is it approaches paying a home loan on a home.

When you obtain from your getting involved entire life insurance coverage plan, the cash value proceeds to expand undisturbed as if you never ever obtained from it in the initial location. This is due to the fact that you are making use of the cash worth and death benefit as collateral for a finance from the life insurance coverage business or as collateral from a third-party loan provider (known as collateral lending).

That's why it's imperative to collaborate with a Licensed Life Insurance policy Broker accredited in Infinite Banking who frameworks your taking part entire life insurance policy policy properly so you can stay clear of unfavorable tax effects. Infinite Financial as a monetary approach is except everybody. Below are a few of the benefits and drawbacks of Infinite Financial you must seriously think about in deciding whether to progress.

Our favored insurance service provider, Equitable Life of Canada, a mutual life insurance policy firm, focuses on getting involved whole life insurance coverage policies particular to Infinite Banking. Also, in a shared life insurance firm, policyholders are considered business co-owners and obtain a share of the divisible surplus generated annually with rewards. We have a selection of carriers to select from, such as Canada Life, Manulife and Sun Lifedepending on the needs of our clients.

Please additionally download our 5 Top Concerns to Ask A Limitless Banking Representative Before You Hire Them. For more information regarding Infinite Financial see: Disclaimer: The product offered in this e-newsletter is for informative and/or academic purposes only. The info, opinions and/or sights expressed in this e-newsletter are those of the writers and not always those of the supplier.

How To Set Up Infinite Banking

The concept of Infinite Financial was developed by Nelson Nash in the 1980s. Nash was a finance professional and fan of the Austrian school of economics, which advocates that the value of goods aren't explicitly the result of typical financial structures like supply and need. Rather, people value cash and goods in different ways based on their economic status and demands.

One of the risks of traditional financial, according to Nash, was high-interest rates on fundings. As well lots of individuals, himself consisted of, obtained right into monetary problem due to reliance on financial establishments.

Infinite Banking needs you to own your monetary future. For goal-oriented individuals, it can be the ideal monetary device ever before. Here are the advantages of Infinite Financial: Probably the single most valuable facet of Infinite Financial is that it boosts your cash flow. You do not require to undergo the hoops of a traditional financial institution to get a financing; simply request a plan financing from your life insurance policy company and funds will be offered to you.

Dividend-paying entire life insurance is extremely low threat and offers you, the insurance policy holder, a fantastic bargain of control. The control that Infinite Banking provides can best be grouped into 2 groups: tax advantages and possession securities.

Whole life insurance plans are non-correlated assets. This is why they work so well as the monetary structure of Infinite Banking. No matter what occurs on the market (stock, actual estate, or otherwise), your insurance plan retains its worth. As well many individuals are missing this important volatility barrier that aids protect and expand wealth, rather splitting their cash into 2 containers: checking account and investments.

Entire life insurance coverage is that third pail. Not just is the price of return on your whole life insurance coverage plan assured, your fatality advantage and premiums are likewise assured.

Infinite Banking Reviews

This framework straightens perfectly with the principles of the Perpetual Wide Range Strategy. Infinite Financial interest those seeking higher economic control. Here are its primary benefits: Liquidity and availability: Plan finances give prompt accessibility to funds without the limitations of typical financial institution financings. Tax effectiveness: The money value expands tax-deferred, and policy financings are tax-free, making it a tax-efficient tool for developing riches.

Asset security: In numerous states, the money worth of life insurance policy is protected from financial institutions, including an additional layer of economic safety and security. While Infinite Financial has its advantages, it isn't a one-size-fits-all solution, and it comes with significant disadvantages. Here's why it may not be the most effective method: Infinite Banking usually calls for complex policy structuring, which can perplex policyholders.

Latest Posts

Be Your Own Bank [Top 7 Benefits Of Being Your Own Banker]

Infinite Banking Definition

Infinite Banking Testimonials